Tax Commissions

The Sac and Fox Nation Tax Commission’s responsibility is to administer and enforce the Nation’s tax laws. The Tax Commission currently has six different types of taxes that are applied throughout Sac and Fox Indian country. These taxes are Tobacco Tax, Sales Tax, Earnings Tax, Oil and Gas Severance Tax, Taxation and Registration of Motor Vehicles, and Gaming Surcharge Tax.

The tax revenue received from these taxes are placed in the Nation’s treasury account. These revenues are used to fund several different programss within the Sac and Fox Nation. The following programs are funded in full or in part by tax revenues: The Tax Commission, Tribal Court, Attorney General, The Sac and Fox Nation Public Library, Fire Department, Tribal Police, Defense of Laws, and General Operating. Other items are funded from tax revenues as needed.

Links

Frequently Asked Questions

What are the requirements for me to be eligible to register my car with the Sac and Fox Tax Commission and get a Sac and Fox tag?

You must be an enrolled Sac and Fox Tribal Member. You must be a resident of and principally garage the vehicle within Sac and Fox Nation jurisdiction.

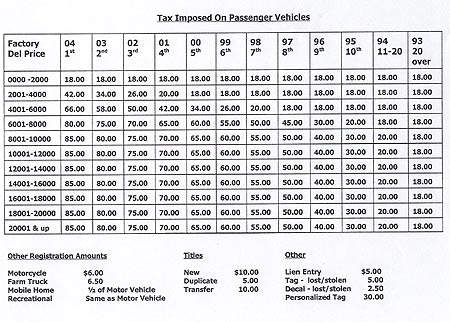

How much will it cost for me to register my car with the Sac and Fox Tax Commission?

The cost of the registration is based on the year model of the vehicle. The cost of registration decreases as the vehicle gets older. The first year the vehicle is registered with the Sac and Fox Tax Commission there is a $10.00 title fee added to the registration cost. For exact cost of registration, contact the Sac and Fox Tax Commission at 918-968-3526.

What information will I need to register my car with the Sac and Fox Tax Commission?

You will need the title to your vehicle and your proof of insurance verification.

When do I need to purchase a sales tax registration permit?

You must purchase a sales tax registration permit any time you conduct any type of sales on Indian Land (Trust Properties, Tribal Land, Indian Housing, Individual Allotments, Restricted Lands) that is within the jurisdictional boundaries of the Sac and Fox Nation.

Where is the jurisdiction of the Sac and Fox Nation?

The Sac and Fox Nation’s jurisdiction covers portions of Payne, Lincoln, and Pottawatomie counties. The northern boundary is the Cimarron river and the southern boundary is the North Canadian River. The Creek Nation lies to the east and the Iowa Tribe and the Kickapoo Tribe lie to the west.

Sales Tax Registration Instructions

EFFECTIVE AUGUST 1, 1994 the Sac and Fox Nation imposed a $5.00 fee on all sales tax registrations issued. The registration (permit) is valid for one (1) year from date of issuance.

In accordance with the Sac & Fox Nation General Revenue and Taxation Law every person conducting sales within the Nation’s jurisdiction is required to apply for and receive a sales tax registration, in addition to collecting a 8% sales tax on items sold (Effective January 1, 2003). The tax collected is to be reported and remitted to the Sac and Fox Tax Commission, on or before the 14th day of the month proceeding the month in which sales were conducted.

• Enclosed is an “application for sales tax registration” which should be completed and returned with the $5.00 fee.

• If prior year sales tax is due and owing the Sac and Fox Nation, payment in full is necessary before the application for a current sales tax registration is processed.

• If you are unsure if the tax has been remitted on prior year/s sales you may contact the Tax Commission.

• If no tax is owed, the registration will be mailed. If payment of past year taxes is due, upon arrival at the Sac and Fox Nation you will be required to notify the Tax Commission to make payment and to receive the Sales Tax Registration.

• When sales are being conducted the registration card must be displayed in the area of sales. Periodic inspections will be performed to insure each vendor is registered and the registrations are displayed.

• A sales tax report form will be provided to each vendor receiving a sales tax registration which needs to be completed and submitted along with the Sales Tax collected.

• The report is due on or before the 14th day of the month preceding the month in which sales were conducted. If submitted after the due date, a late penalty is imposed at the rate of 1.66% per month.

Tax Commission staff will be available to assist vendors with completion of the form and/or to answer any questions. (918) 968-3526